Foresights and ideas that expand minds and inspire a change of heart.

As you may know, we recently conducted an extensive consumer research piece. It’s given us great insight into Australians’ thoughts around AI, the future and robots.

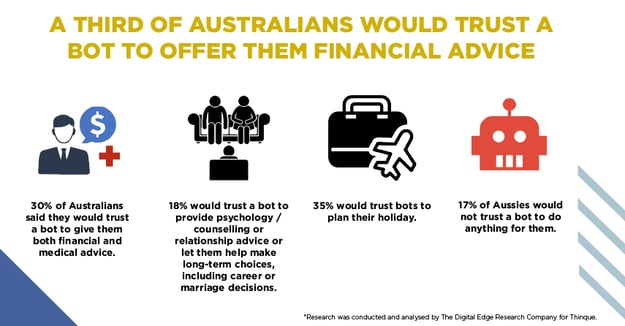

In the second part of our research, we asked consumers in which areas they would be happy to receive advice from robo-advisors. The results were really interesting and highlighted that in the wake of the Banking Royal Commission, Australians’ distrust in the financial sector is high.

In fact, the study showed that 30% of Australians would trust a robot to offer them financial advice. Tellingly, this is compared to just 9% of respondents who would trust a robot to provide them with psychology/counselling or relationship advice or allow bots to help them make other long-term choices, such as career or marriage decisions. In other words, we trust robots with our money but not our hearts.

I have found Australian attitudes toward AI and robotics fascinating in demonstrating changing consumer thought patterns. Whereas previously Australians have trusted digital tools with purely transactional activities such as mobile payments, the research clearly demonstrates that when it comes to more strategic life advice, we are now beginning to trust AI to advise us in sectors such as health, finances and banking.

What’s more, we are also increasingly entrusting robots in the finance/financial advice sector, as many Australians’ distrust in human advisors has mushroomed in the wake of the Royal Commission. During the last few years, the FinTech sector, their User-Centric Customer Experiences and their seamless solutions have grown “digitally empathetic”, which has led to their mainstream adoption.

Despite our increasing trust in financial robo-advisors to guide our decisions, the research also highlights that fraud is still a key concern in the financial services sector more broadly, with those surveyed stating that this sector is where they are most concerned about digital fraud (80%) – compared to the Government/public sector (56%), insurance (46%), health (39%), property (37%) and retail (35%)**.

When asked why they felt this way, reasons provided centred around worries about information getting into the wrong hands, hackers/thieves evolving faster than corporate cybersecurity technology and the belief that there isn’t enough moderation of advancing technology.

What this research shows me is that with public distrust in the financial industry at an all-time high, banks, retailers and financial brands must place even greater importance on offering seamless customer transactions, ensuring that their money is in safe hands at all times (while also offering value-added advisory services). With ‘pinflation’ (my term for using the same pin for everything or the mismanagement of a multitude of pins), Australians are becoming very exposed to hackers and fraud, a feeling that is reflected in the sentiment of the research. In turn, consumers must learn to scenario plan when it comes to fraud or the use of robo (or human) advisors, to ensure their financial safety in any eventuality.

In turn, financial advisors in particular need to look at how to rebuild public trust in this digital age. They have lost their voice and partly forgotten their ability to story-tell and build a narrative of trust—digitally—and are thus failing to re-engage Australians at a time when more Australians than ever need financial advice.

When looking further ahead, the financial services will also be rocked by innovations, such as Open Banking fully coming into play and is already in place in other markets around the world. Open Banking requires regulated banks to allow customers to share their financial data with authorised third-party providers (like FinTechs) through APIs. This is to allow consumers to switch banks easily and score themselves a better deal, driving established banks to invest thoroughly in offering the very best customer experience or face the risk of losing many clients to FinTechs.

Keep checking back in to read more of our research foresight over the coming months.

To meet the challenge of the changing landscape for financial advisors, I was recently engaged by Zurich to help them scenario plan for the future of their business, as well as in an ambassador role, to help them engage financial advisor partners. Here you can download the findings which we turned into a trend report.

*Research was conducted and analysed by The Digital Edge Research Company for Thinque. The data is based on analysis of over 1,000 Australian responses in January 2019. The ages used for this study were 18 – 70+ years old and consisted of a mix of both male and female respondents from across the country.

**Respondents were able to select multiple answers.

Header Text

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Header Text

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Header Text

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

& STAY UP TO DATE WITH FORESIGHTS AND TREND REPORTS!

WE WILL EQUIP YOU WITH THE VIDEOS AND MATERIALS YOU NEED TO SUCCESSFULLY PITCH ASN.

0 Comment