Foresights and ideas that expand minds and inspire a change of heart.

Digital communication gives us an opportunity to move away from pure demographics into micro-segmenting psychographics of our audiences focusing in on customer values, attitudes, behaviours and interests. How would you do that? Well, does someone like your organisation on Facebook for example? Do they really like icehockey, are they a Rapid Vienna fan or Austria fan? Whoever they happen to be all of a sudden we are getting a richer perspective of our customers which is enabling us to win both digital minds and analogue hearts into the future. More data and insights about your customers enables you to create personalized offers, products and services that resonate with the needs, beliefs and values that your customers have.

If we look at the growth of mobile devices in Central and Eastern Europe we can see that we are likely to see a significant growth of mobile devices and massive adoption rates in the next couple of years. And Bukarest in Romania is now being called the new Silicon Valley of Europe because of its startup activity. This country, I'm told by my Romanian friends, does not have the physical infrastructure to compete on par with more advanced economies so they have to rely on their digital infrastructure to be competitive in the future. Mobile devices enable us to create trust seamlessly no matter where in the world we are. The interface and the visualisations that today's mobile devices can provide us with helps us make smarter decisions in real-time.

How do businesses create seamless customer journeys across the physical and the digital (divide or provide)? In order to answer this question we need to zoom out, out of our own existing touchpoints and stop focusing on just adding another channel. Instead you should think about how you can integrate those channels in an omni-channel mix - seamlessly. Ask yourself what are the analogue and digital touchpoints we need during pre-sale and post-sale and how do we make a personalized customer journey that is individually targeted to your unique customers.

The question is how are you going to map your unique customer journeys and what kind of touchpoints do you want to ensure that you capture both the digital minds and analogue hearts in those decisive micro-moments your clients go through (as Google likes to call them).

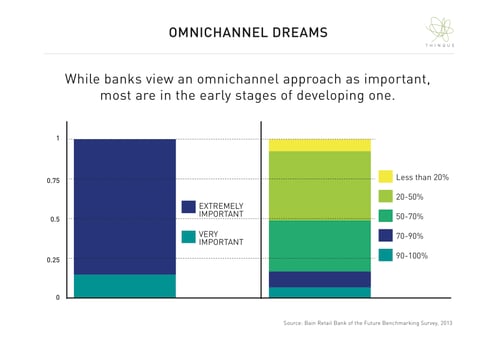

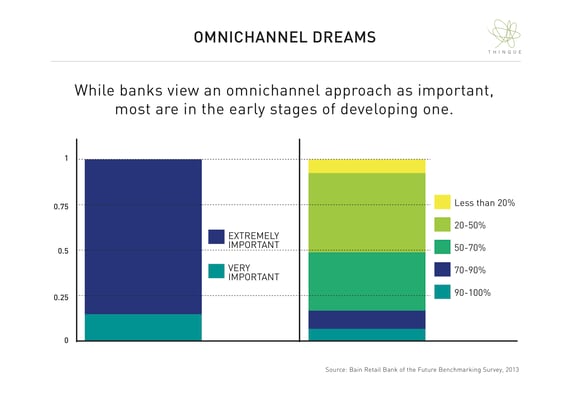

According to the report Building the retail bank of the future by Bain & Company, banks view an omni-channel approach as important, however most are in the early stages of developing one. Creating a customer journey is a continuous process which is not additive, but integrative instead.

According to the report Building the retail bank of the future by Bain & Company, banks view an omni-channel approach as important, however most are in the early stages of developing one. Creating a customer journey is a continuous process which is not additive, but integrative instead.

For further reading about trends impacting the future of banking check out these blog posts:

Do you want your brand to thrive in today's digital landscape? Our Brand Workbook will help you with great models and insightful questions to get you thinking about creating a more impactful future brand. Download it now!

Header Text

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Header Text

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Header Text

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

& STAY UP TO DATE WITH FORESIGHTS AND TREND REPORTS!

WE WILL EQUIP YOU WITH THE VIDEOS AND MATERIALS YOU NEED TO SUCCESSFULLY PITCH ASN.

0 Comment