Foresights and ideas that expand minds and inspire a change of heart.

The technology we like to use socially is now making a move into the corporate space which means that business to business clients are no longer wanting to fly and pay in business class, but have an economy class experience.

They don't want to trade superior social technology for worse corporate interfaces when they do their banking and this is the argument that these technology trends are not just consumer trends, but through consumerization they are also highly relevant for businesses in B2B banking.

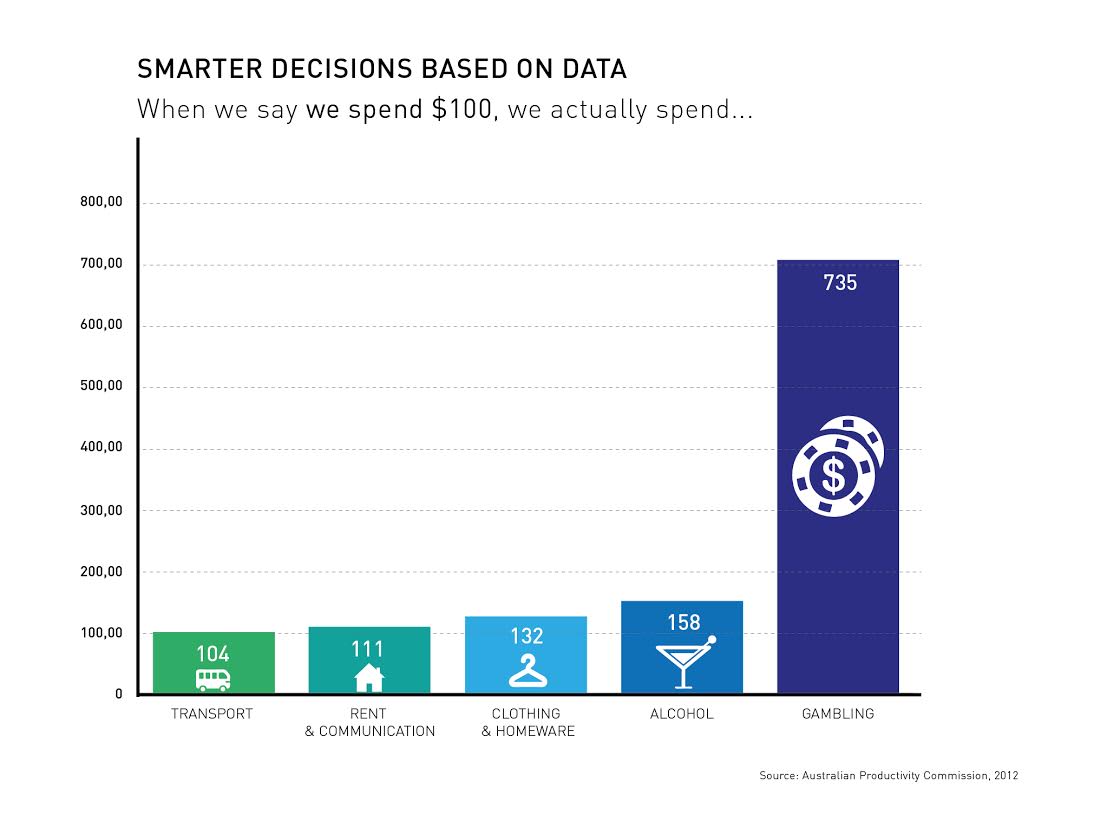

We are not just digitizing our minds, our minds are also increasingly mobilizing. Let me share some quick research about how we think about our money when we listen to our gut feel. The Australian Bureau of Statistics and the Australian Productivity Commission who conducted the study asked the research participants "how much money do you spend on XYZ in your household". Then they audited what people actually spent. So for example when people said they spent $100 on transport, the real audited amount was $104, but it gets more worrying, see the graph above. When we say we spend a $100 on the pub last night, we actually spend $158. And finally when we say we spend $100 on gambling, we actually spend $735. So when we listen to our gut instinct in the context of money and as consumers we suck.

We are not just digitizing our minds, our minds are also increasingly mobilizing. Let me share some quick research about how we think about our money when we listen to our gut feel. The Australian Bureau of Statistics and the Australian Productivity Commission who conducted the study asked the research participants "how much money do you spend on XYZ in your household". Then they audited what people actually spent. So for example when people said they spent $100 on transport, the real audited amount was $104, but it gets more worrying, see the graph above. When we say we spend a $100 on the pub last night, we actually spend $158. And finally when we say we spend $100 on gambling, we actually spend $735. So when we listen to our gut instinct in the context of money and as consumers we suck.

The consumer of tomorrow is expecting better digitization and visualization of our finance and our daily lives. We know that seamless technologies are coming in over the top and disrupting higly regulated industries like the taxi industry. You have probably all heard of how Uber is disrupting the taxi industry. They offer their customers a beautiful interface in real-time and on-demand and therein helping their costumers to make smarter decisions.

Through mobile interfaces and mobile user experiences our customers, be they B2B or B2C can start making smarter decisions that are financially empowering them into the future. This is my and Thinque's future insights into how collaborative consumerization will shape the future of banking. Check out the video to get a real-time insight from one of our banking client's recent Nordic leadership conferences.

Header Text

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Header Text

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Header Text

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

& STAY UP TO DATE WITH FORESIGHTS AND TREND REPORTS!

WE WILL EQUIP YOU WITH THE VIDEOS AND MATERIALS YOU NEED TO SUCCESSFULLY PITCH ASN.

0 Comment