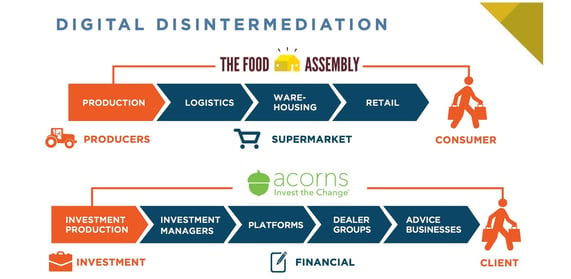

Disintermediation is defined as the process of eliminating the intermediary in a transaction between two parties. The digitisation has disintermediated several industries such as hospitality, retail, transportation and music. Two other industries that are facing similar challenges are the food and financial advice industry.

A visualisation of digital disintermediation in the food and financial advice industry.

The Food Assembly is a platform that connects consumers directly with a network of farmers. This is of course beneficial for both the individual consumer and the farmer - the consumer gets access to local quality food at a reasonable price while the farmer gets to keep over 80% of the price for every product sold. In other words, it's a win-win situation for both parties. However, the intermediary which in this case is the supermarket will not benefit from this since they are being cut out of the equation.

Another industry that's facing digital disintermediation is the financial advice sector. Robo-advisory platforms / online advisory platforms are reshaping the industry and bringing value to its customers in new and innovative ways. One successful company is Acorns which is a micro investment app that seamlessly turns your spare change into investments. This app enables its users to manage their funds and receive financial advice without meeting a human financial advisor. The investment process is automated and has been developed by a team of engineers, mathematicians and the Nobel Prize-winning economist Dr. Harry Markowitz who is often referred to as ”The Father of Modern Portfolio Theory”.

Picture from TechCrunch.

From these two cases of disintermediation we can conclude that businesses need to be agile and constantly re-evaluate not just their marketing strategies but also their business models. Additionally, they need to think about how they create value for their customers and where they are in the value chain. Especially intermediaries like real estate agents, travel agents and stock brokers must consider how they deliver value in a future that's increasingly digitised.

Sign up for our newsletter and stay updated with the latest future trends from Anders Sörman-Nilsson and Thinque.