We've previously written about Sweden, which except for Abba and IKEA, now are famous for being the most cashless society in the world. Niklas Arvidsson, professor in payment systems at Stockholm’s Royal Institute of Technology (KTH), said in article that he believes that Sweden will be more or less a cashless society within five years. Another country which are being impacted by the digital revolution and thus marching towards becoming a cashless society is Australia.

Image from Tanner Goods.

Cash dropped from 70% to 47% of transactions between 2007 and 2013, and the demand for coins has dropped by 25% in the last three years according to an article in the Sydney Morning Herald. Like the change to decimal currency 50 years ago, the move to a cashless society will be a fundamental shift in the way Australia's payment system operates, said the Assistant Minister to the Treasurer, Alex Hawke. Moreover, he said that the government must do more in order to keep up with this consumer and business-driven shift in the way Australians shop.

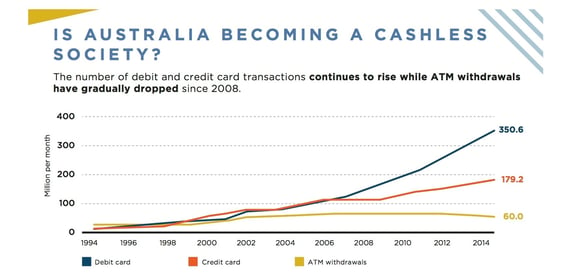

As you can see from the graph above, the number of debit and credit card transactions continues to rise while ATM withdrawals have gradually dropped since 2008.

From this we can conclude that the role of cash has changed in today's post-digital-disrupted society. The expression cash is king will probably lose its relevancy. Meanwhile, we are seeing that Bitcoin and other alternative digital standards for the transactions of value rise and consequently people are starting to embrace a new way to pay for things or receive value from somebody else. This is a development which is even making banks and central banks worried.

It's hard to make a precise prediction on how the future for cash or payments will look like, but what we can assume is that consumers will choose the options which they perceive to be the most seamless. Consumers want solutions and technologies that can simplify their lives and enable smarter decision-making. A few examples of such solutions is Nike's new app and banking apps from FinTech companies like Tink, Simple, Moven and Pocketbook.